For those new to online banking: click here to get started.

Paying down one debt is hard enough, but paying off multiple debts can be overwhelming. You have to make multiple payments with multiple deadlines, all while being mindful of each loan’s terms and conditions. Wouldn’t it be nice if you could just make one monthly payment to cover all your debts? Even better, what if all your debts had the same low interest rate so you could pay them off faster and even save money? Good news, that’s what debt consolidation loans are for!

If you're reading this you've probably been looking for options to get out of debt, you may have come across debt consolidation loans as one of those options. You may also be wondering what is debt consolidation?

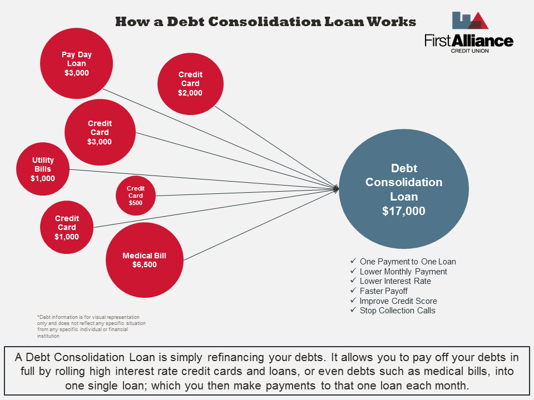

Put simply, debt consolidation is when you combine multiple debts into one single loan providing you one monthly payment. It is the process of refinancing your debts. This is typically accomplished by taking out a debt consolidation loan, usually a personal loan, that is used to pay off all your existing debts. However, many people have also used home equity loans and credit card balance transfer programs to consolidate their debts.

Once you’ve consolidated your debts, you’ll still owe the same total amount of your debt, but your monthly payment will be lower. This is because the loan has a fixed payment. In addition, a debt consolidation loan usually provides a lower interest rate, so you’ll end up paying less overall.

Debt consolidation also gives you the benefit of a fixed time frame in which to pay off your debt. This can be especially appealing when compared with the revolving nature of credit cards, where too many people get caught in a cycle of adding to their debt faster than they are paying it down, which creates a debt load that becomes difficult to completely pay off.

When considering debt consolidation, it’s important to talk to a qualified debt consolidation lender or other trusted financial advisor to see which debt consolidation option is best for your current situation and credit mix.

One of the best benefits of debt consolidation is the various types of debts you can consolidate. You can consolidate credit card debt, high interest personal loan debt and even outstanding medical bills. The types of debt that can be consolidated include:

The type of debt you are looking to consolidate will determine which debt consolidation loan option will be the biggest benefit to you. It is important talk with a trusted lender about your debt consolidation goals before moving forward.

Now that you know what debt consolidation is and how to get debt under control using a debt consolidation loan, you might be wondering about the specific benefits. After all, you’ll have to take out yet another loan in order to consolidate all your debts, which requires quite a bit of preparation and effort. In other words, are debt consolidation loans worth it?

The fact is that debt consolidation offers several benefits beyond just making it easier to manage and pay your bills. A debt consolidation loan can help you in five specific ways:

Debt consolidation is best for someone who is paying high interest rates on multiple debts or is struggling to pay all their debts on time every month. There are definitely situations where debt consolidation isn’t needed. For example, when the interest rates that people currently have are better than what can be offered through a debt consolidation loan.

Since your credit mix and financial situation are unique to you, it will be important to talk with a knowledgeable lender about your current debt and your financial goals before applying for a debt consolidation loan.

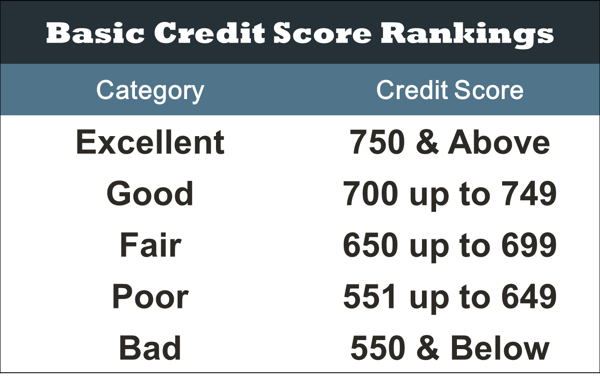

One of the biggest effects of debt consolidation is on your credit score. Your credit score is numerical snapshot of how your have managed your debt over time.

Credit scores range from 300 to 850. Scores under 650 are usually considered to be fair or poor, scores in the mid-600s or higher are generally regarded as acceptable or good, and scores greater than 750 are considered to be excellent. The chart below summarizes these credit score tiers:

Your credit score fluctuates as your financial situation shifts, such as getting another credit card, having late credit card payments, or paying off debt. While some parts of the debt consolidation process might lower your credit score, for the most part debt consolidation will positively effect your credit score.

For instance, if you opt for a consolidation loan or a balance transfer, the financial institution will make a hard inquiry into your credit. Any time that happens, your credit score will take a slight dip. You may also notice a drop in your credit score if you pay off debt and then close all your credit lines, as this decreases your credit availability.

However, a debt consolidation loan can also boost your credit score substantially by lowering your credit utilization—the amount of debt you carry as compared to the total amount of debt available to you. If you use a debt consolidation loan to consolidate credit card debt, your credit availability will be at 100% immediately. This can increase your credit score by up to 100 points.

The exact effects of debt consolidation on your credit score depend greatly on your personal circumstances. In some cases, you’ll want to close off credit lines, while in other cases you may want to keep credit lines open, with the understanding they won’t be used in the same manner as before. You’ll want to talk with a lending advisor beforehand in order to figure out the best course of action.

There are several different kinds of debt consolidation loans, each with different structures, requirements, and payment terms. Consider your financial situation and credit mix before deciding which debt consolidation option is best for you.

Personal loans (a.k.a. signature loans) can be used as debt consolidation loans if you can borrow a loan large enough to cover all your balances. Depending on your credit rating, you could have trouble getting approved for a personal loan. People with lower credit scores may not get approved at all, or they may get approved but at a higher interest rate. However, there are options such as secured debt consolidation loans for those in this situation.

This type of consolidation loan use something of value, such as your vehicle or real estate, as collateral for your loan. When you have collateral attached to your loan it allows you to qualify for higher loan amounts and can lower the interest rate of your loan. Secured debt consolidation loans are common option for those who may have lower credit scores. Each financial institution has different requirements for what is considered to have enough value to be use as collateral. It's also important to note that there is a slight disadvantage to this type of loan over using a personal loan, if you default on your payment, you risk losing the item you pledged as collateral.

With a credit card balance transfer, you transfer your credit card balances onto a single credit card, ideally with a lower interest rate.

If you can qualify for a credit card with a 0% interest rate for 12 months or more, you may want to transfer all of your balances to that one card instead of getting a debt consolidation loan, especially if you have $5,000 or less in credit card debt.

One of the biggest differences between a debt consolidation loan vs. a balance transfer is that many low balance transfer interest rates are promotional rates that expire after a certain amount of time, usually between 6 – 18 months. If you choose to transfer balances, make sure you read the fine print of your agreement to know when the promotional rate will expire and what the new interest rate will be on any remaining balance. You'll also need to find a credit card with a large enough credit limit to hold however much debt you have.

It is important to note that putting too much debt on one credit card could have a negative impact on your credit score as your credit utilization goes up, but your credit score can rebound quickly as you pay down the balance.

A home equity loan is a fixed rate loan with a fixed term, usually 10 years, that's taken out using your home as collateral. You usually need to have enough equity in your home and good credit to qualify for this type of loan.

While the interest rates are typically lower on a home equity loan than other types of loans, if you find yourself not able to make the payments, you may face foreclosure on your home. If you are planning to use a home equity loan to pay off your debt, you need to have a solid management plan in place to keep you from defaulting. It's also important to note that home equity loans come with closing costs and fees, you will need to make sure you can afford to pay these extra fees or they may be able to be rolled into the loan.

A Home Equity Line of Credit (HELOC), is a variable rate line of credit, which also uses the equity in your home as collateral. Again, you usually need to have enough equity in your home and good credit to qualify for this type of loan.

Interest rates are also typically lower on HELOC loans. The difference is, the interest rate is variable, and it usually changes when the Prime Rate changes, which means the interest rate could change on a quarterly basis. Again, if you find yourself not able to make the payments, you may face foreclosure on your home. Home equity lines of credit also come with closing costs and fees that will need to be paid upfront or rolled into the loan.

Once you’ve decided to consolidate your debts, you’ll need to apply for a debt consolidation loan. Getting a loan can seem daunting to many people, but if you follow four basic steps, you’ll be sure to get the debt consolidation help you need.

Before applying for a debt consolidation loan, or any other loan, you need to have a solid understanding of your financial situation.

Once you have an understanding of your total debt levels, you can start looking for a financial institution to work with.

You can usually schedule a debt consolidation loan meeting on the company’s website or by calling them.

Make sure you’re willing to be open and honest about where you are financially. Lending advisors don’t like surprises, and you’re better off being honest and explaining how a debt consolidation loan will make paying your debts easier.

Here are some things that the lending advisor will do during your meeting:

After meeting with a lending advisor about your financial situation, if you both agree that a debt consolidation loan is still your best choice, then you will also need to provide several key pieces of information to move forward with the debt consolidation application, including:

After meeting with a lending advisor about your financial situation, if you both agree that a debt consolidation loan is still your best choice, then you will also need to provide several key pieces of information to move forward with the debt consolidation application, including:

If you’re planning to apply for a secured debt consolidation loan, however, you will also need to supply some additional details based on the type of collateral you’re using to secure the loan. The most common collateral used for secured debt consolidation loans are vehicles and real estate.

Each lender will have different guidelines for the collateral you can use on a secured debt consolidation loan. Be sure to ask your chosen lender up-front about their collateral requirements.

Once the lending advisor has presented you with the potential terms of the loan you qualify for, look it over carefully. If the terms of the loan will allow you to have a smaller total monthly payment, reduced interest rates, faster time to pay off and/or improve your credit score, then it’s safe to sign on the dotted line.

By this point, you probably know what debt consolidation loans are and how they can help you if you're struggling to manage multiple debts. However, you might also be thinking “It’s great that debt consolidation loans work for some people, but is there any way I can see how I come out ahead if I consolidate my debts?”

In fact, there is. The First Alliance Debt Consolidation Calculator can help you see how much time and money you’ll save if you get a debt consolidation loan.

All you have to do is enter in some information about each of your debts, then enter the terms of your debt consolidation loan. The calculator will then show you how long paying off your existing debts will take, as well as the total interest paid, and compare that to how long you’ll need to pay off the debt consolidation loan and the total interest you’ll pay. The only danger is you might wish you’d applied for a debt consolidation loan sooner once you see how much you’ll save.

© 2018 - 2023 First Alliance Credit Union | 501 16th St. SE Rochester, MN 55904 | (507) 288-0330

Privacy Policy | Routing Number: 291975481

Affiliate Site Disclaimer: Our website privacy and security policies only provide protection via the domains owned and operated by the credit union: firstalliancecu.com and resources.firstalliancecu.com. By accessing any linked website not hosted on the listed domains you will be leaving our website and entering an affiliate site which is hosted and controlled by another party. Please be advised that you will no longer be subject to, or under the protection of, the privacy and security policies of our website. We encourage you to read and evaluate the privacy and security policies of the website which you are entering, which may be different than those of ours. Inclusion of any linked website on our site does not imply approval or endorsement of the linked website by us. This remains true even where the linked site appears within the parameters or window/frame of our site. We are not responsible for practices employed by websites linked to or from our website, nor the information, content, accuracy, or opinions expressed in such websites, and such websites are not investigated, monitored or checked for accuracy or completeness by us, nor do we maintain any editorial or other control over third-party websites. Your browsing and interaction on any other website, including websites which have a link to our site, is subject to that website's own rules and policies. If you decide to leave our website and access any third-party websites, you do so solely at your own risk.

In accordance with federal law and U.S. Department of the Treasury policy, this institution is prohibited from discriminating based on race, color, national origin, sex, age, or disability. Submit a complaint of discrimination, by mail to U.S. Department of the Treasury, Office of Civil Rights and Equal Employment Opportunity , 1500 Pennsylvania Ave. N.W., Washington, D.C. 20220, (202) 622-1160 (phone), (202) 622-0367 (fax), or email crcomplaints@treasury.gov.