For those new to online banking: click here to get started.

Your credit score has an enormous impact on your financial life. You might be aware that it affects how much you can borrow from a financial institution for a car or house, as well as what your payments will be. However, you might not know that your credit score can even affect your ability to rent an apartment or get a job. With so much at stake, you need to know what a credit score is and how credit scores work. This guide will help you understand credit scores and show you how to build yours up to take control of your financial future.

So, what is a credit score exactly? The short answer it’s a three-digit number that many financial institutions use to gauge the risk of loaning money to you. The higher your credit score, the more likely it is you’ll pay back the money you borrow.

The long answer is that your credit score is a score based on the information in your credit report. Your credit report contains your personal information, which creditors will use to confirm your identity, as well as your payment history on accounts in your name including:

Your credit report will also show any hard credit inquiries in the past two years, which just means the number of times a lender has received your permission to look at all the information in your credit report. It can leave a mark on your credit report, but the effect is generally negligible—unless your credit report shows too many hard credit inquiries in a short period.

Some people also call credit scores FICO scores. What is a FICO score? It’s simply the industry standard formula developed by the Fair Isaac Corporation to determine your credit score, and many people use the terms synonymously.

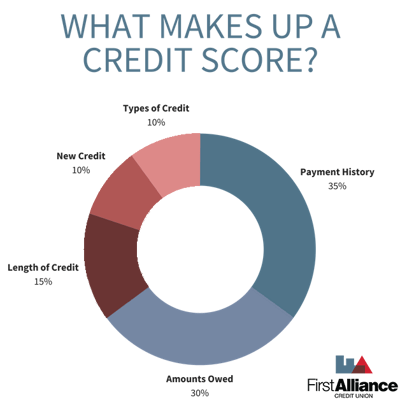

Credit rating agencies determine your credit score based on five key factors from your report. However, they consider some factors more important than others.

You should also know that you don’t have just one credit score. There are three national credit bureaus—Equifax, Experian and TransUnion—and they all calculate their scores independently of each other. This is why you might be asking why are my credit scores different across various lenders or online credit score apps

Even though you will have three different credit scores, they shouldn’t vary too much from each other. If one score is very different than the others, though, you’ll want to review that bureau’s credit report to make sure it doesn’t contain any erroneous information.

So why do credit scores matter?

Since your credit score sums up all the information on your credit report, many businesses use it as a benchmark to determine not just your financial health, but how reliable you are at making payments on-time. As a result, your credit score may determine:

Since your credit score affects so many aspects of your life, you need to monitor it regularly. Here are a few ways to check your credit score:

In addition to checking credit scores, it’s a good idea to regularly check your credit reports to ensure that the information is accurate and complete. One of the best ways to do that is by requesting a free copy of your credit report from each of the three major credit bureaus once every 12 months at www.annualcreditreport.com. Make sure to review each of the credit reports from the three bureaus carefully to make sure none of them contain inconsistent information or inaccuracies.

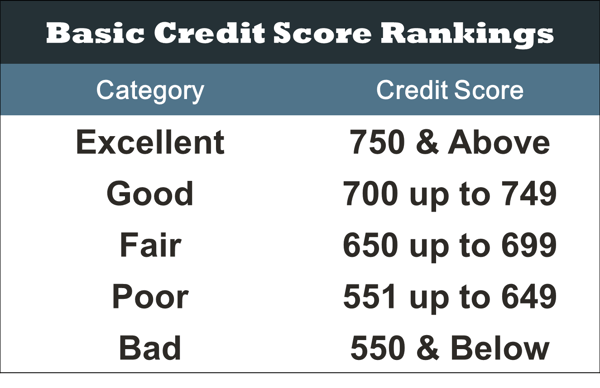

Credit scores typically range from 300 – 850. The higher your credit score the better. Here’s a closer look at what your credit score might indicate to your lender.

You may also see some lenders give a letter grade to credit scores. Here’s how it works:

Some financial institutions may even break these grades down further into sub-ratings, such as A+ credit or C - credit, based on their lending guidelines and risk rating structures.

So how exactly do you get that coveted 700+ score? While there is no one magic formula that will give you a high credit score, we have pulled together five steps that will help you build a solid credit score, even if you have no credit score at all:

Since your payment history is the biggest factor that can affect your credit score, you’ll want to make sure your bills are paid on time. Fortunately, this is also one of the easiest parts of your credit score to manage, since you are in control of when you pay your bills.

Owing money is not necessarily a bad thing when it comes to credit scores. The key to good credit management is to be aware of how much you owe on revolving credit accounts such as credit cards. The bigger your balances, the more concerned lenders will be that you are overextending yourself.

While you only need six months of credit activity to begin building your credit score, the longer you’ve had the same accounts open, the better picture lenders have of your financial behavior, especially when it comes to repaying loans and credit cards.

Opening new credit accounts have an impact on your credit score. Obtaining too many credit cards to quickly, can negatively impact your score. This is especially true if you're obtaining credit for the first time.

Credit mix is the combination of credit cards, installment loans (like personal loans and vehicle loans), finance company accounts and mortgages you have. You don't need to have each type of loan, but you also do not need to open credit accounts if you don't need them.

If your credit isn’t as high as you’d like, the good news is you can rebuild a poor credit score. The bad news, though, is that it will take time. Here’s how to improve your credit score:

Once you’ve taken these actions, you’ll probably be curious about when credit scores update. While you might see your score go up one or two points a week or two after you start rebuilding your credit, you should wait about a month before expecting any real results. This is because how fast a credit score changes depends on when the credit bureaus get the information from your creditors, which usually happens once a month.

How fast does a credit score change? If you’ve started making regular payments, it will probably take about a few months to see some real results. Remember credit scores reflect your payment history over time, so you’ll need to be consistent over several months.

If you’ve had to declare bankruptcy, however, you’ll have to wait a bit longer for your credit score to improve. You’ve probably already asked “Will bankruptcy hurt my credit?” before filing and realized that it will, but you might not know that once you’ve declared bankruptcy, you’ll have to wait 12-18 months before your credit score starts to rise. However, it will take about 7 years for the bankruptcy to be completely fall off your credit report.

Contact a Member Experience Advisor at First Alliance Credit Union for a credit review. We’ll help you improve your credit score. You can also monitor your score using the free credit score tool we offer on our online banking platform and mobile app.

© 2018 - 2022 First Alliance Credit Union | 501 16th St. SE Rochester, MN 55904 | (507) 288-0330

Privacy Policy | Routing Number: 291975481

Affiliate Site Disclaimer: Our website privacy and security policies only provide protection via the domains owned and operated by the credit union: firstalliancecu.com and resources.firstalliancecu.com. By accessing any linked website not hosted on the listed domains you will be leaving our website and entering an affiliate site which is hosted and controlled by another party. Please be advised that you will no longer be subject to, or under the protection of, the privacy and security policies of our website. We encourage you to read and evaluate the privacy and security policies of the website which you are entering, which may be different than those of ours. Inclusion of any linked website on our site does not imply approval or endorsement of the linked website by us. This remains true even where the linked site appears within the parameters or window/frame of our site. We are not responsible for practices employed by websites linked to or from our website, nor the information, content, accuracy, or opinions expressed in such websites, and such websites are not investigated, monitored or checked for accuracy or completeness by us, nor do we maintain any editorial or other control over third-party websites. Your browsing and interaction on any other website, including websites which have a link to our site, is subject to that website's own rules and policies. If you decide to leave our website and access any third-party websites, you do so solely at your own risk.