As your credit score improves, so should your interest rate! A lower rate means you save money by paying less interest on your loan. That's why we are pleased to offer our members our unique Rate Reboot program. It's our way to celebrate 🎉 and reward 🏆your financial success.

We will use your improved credit score to REBOOT your interest rate to save you money. If you've had your First Alliance loan for at least 12 months and your credit score has improved according to our free credit score tool, request your rate reboot today by filling out the form below!

Step 1: Have a First Alliance Credit Union vehicle loan or personal loan. (Don't have one yet? Apply here!)

Step 2: Use our free credit score tool within Online and Mobile Banking to keep track of your credit score. (App available for Apple & Android devices!)

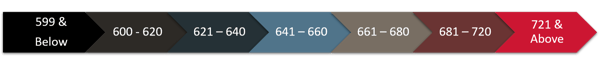

Step 3: Watch for your credit score to improve enough to jump credit tiers, see chart below. (How do scores improve?)

Step 4: Complete the form below to request your one-time Rate Reboot and start saving money! (Have questions first? Let's talk.)

Disclosure: Rate Reboot offer applies to First Alliance vehicle and personal loans only, that have been open for at least 12 months. Lines of credit, real estate loans and credit cards are not eligible for this offer. A rate reboot offer is only available once per loan. New rate is based on credit score at the time of the request. This offer is not a guarantee that a new rate will be provided.

© 2018 - 2022 First Alliance Credit Union | 501 16th St. SE Rochester, MN 55904 | (507) 288-0330

Privacy Policy | Routing Number: 291975481

Affiliate Site Disclaimer: Our website privacy and security policies only provide protection via the domains owned and operated by the credit union: firstalliancecu.com and resources.firstalliancecu.com. By accessing any linked website not hosted on the listed domains you will be leaving our website and entering an affiliate site which is hosted and controlled by another party. Please be advised that you will no longer be subject to, or under the protection of, the privacy and security policies of our website. We encourage you to read and evaluate the privacy and security policies of the website which you are entering, which may be different than those of ours. Inclusion of any linked website on our site does not imply approval or endorsement of the linked website by us. This remains true even where the linked site appears within the parameters or window/frame of our site. We are not responsible for practices employed by websites linked to or from our website, nor the information, content, accuracy, or opinions expressed in such websites, and such websites are not investigated, monitored or checked for accuracy or completeness by us, nor do we maintain any editorial or other control over third-party websites. Your browsing and interaction on any other website, including websites which have a link to our site, is subject to that website's own rules and policies. If you decide to leave our website and access any third-party websites, you do so solely at your own risk.